Educational Blogs

Schedule a Meeting With Daniel Crosby or Call 909-532-3748

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Pacific Empire Financial, deems reliable but in no way does Pacific Empire Financial guarantee its accuracy or completeness. Pacific Empire Financial had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Pacific Empire Financial. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Pacific Empire Financial, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Retirement Planning Heading Into 2026: 7 Smart Moves For Clients Right Now

As 2025 winds down, retirement planning is shifting under three big spotlights: taxes in 2026, retirement plan rule updates, and Medicare drug-cost changes. Here’s a practical, client-friendly guide you can publish — plus talking points to spark action before...

Why Life Insurance Belongs in Your Retirement Plan

Quick Take Life insurance isn’t just for parents with mortgages. The right policy can: protect a spouse’s income plan if one Social Security check disappears create tax-advantaged cash you can access in down markets cover final expenses and debts so heirs keep what...

Annuities 101: Why They’re (Sometimes) a Great Idea for Retirement

Quick Take Annuities are insurance contracts that can turn a portion of your savings into guaranteed income you can’t outlive. For the right person, they lower stress, steady cash flow, and reduce the chances of running out of money—especially when markets are jumpy....

Retirement Income Planning: A Practical Guide for Turning Savings Into a Sustainable Paycheck

Key Takeaways (TL;DR) Retirement success is less about “the number” and more about cash-flow durability, tax efficiency, and risk control. A resilient plan blends guaranteed income (Social Security, pensions, annuity floors) with market growth and cash reserves. Smart...

Integrating Life Insurance & Fixed Indexed Annuities: A Smarter Way to Protect, Grow, and Distribute Retirement Wealth

Big idea: Life insurance and fixed indexed annuities (FIAs) aren’t either/or. Used together, they can help protect income, manage taxes, and transfer wealth more efficiently—especially in volatile markets. Why these two tools belong in the same conversation Most...

Why Fixed Indexed Annuities Are a Smart Choice for Retirement Planning

When planning for retirement, one of the greatest challenges is balancing growth potential with protection of principal. Many investors seek opportunities that allow for upside potential without exposing their hard-earned savings to the full risk of market volatility....

The 4% Rule: How Much Can You Spend in Retirement?

How much can you spend without running out of money? The 4% rule is a popular rule of thumb, but you can do better. Here are guidelines for finding your personalized spending rate. You've worked hard to save for retirement, and now you're ready to turn your savings...

Fixed Index Annuity

Why Annuities May Be a Safer Bet in 2025

Many people decide to claim their Social Security benefit when they retire. You may be one of them. It could be that you need the money, or maybe you want to invest it in the hope that it grows. While these can be good options depending on your needs and preferences,...

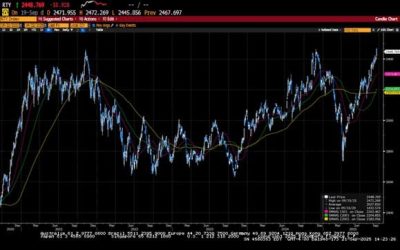

Weekly Market Commentary

Markets were choppy and ended the week with mixed results. Investors poured into risk assets on the idea that the longest US government shutdown was over, but a more hawkish tone from several Fed officials recalibrated expectations for a December rate cut and...

Weekly Market Commentary

Well, the market finally had a significant pullback, but not before the S&P 500 and NASDAQ were able to set another all-time high. The week began with a deal between OpenAI and AMD, sending AMD shares nearly 24% higher. The deal catalyzed the technology sector...

Weekly Market Commentary

Investors sent US markets to another set of all-time highs despite concerns about an extended government shutdown. The U.S. government shutdown was largely dismissed by markets last week, which came as a surprise given that several key economic data sets (Initial...

Weekly Market Commentary

The S&P 500 hit a 28th record high for the year before settling lower for the week. Investors endured a choppy week of trading as better-than-expected economic data and better-than-feared inflation data tempered the notion of additional rate cuts. Several Fed...

Weekly Market Commentary

The major US equity market indices forged another set of all-time highs as investors went all in on risk assets after the Federal Reserve announced a twenty-five basis point cut to its policy rate and telegraphed the potential for three more cuts by January 2026. The...

Weekly Market Commentary

US equity indices posted another set of all-time highs as investors increased expectations for three, twenty-five basis point rate cuts by year's end. Inflation data reported for the week essentially gave the Fed the green light for a September rate cut....

Weekly Market Commentary

Investors sent the S&P 500 to another all-time high in a holiday-shortened week of trading. President Trump started the week by asking the Supreme Court to expedite a hearing to challenge the International Trade Court and the Federal Court of Appeals rulings that...

Weekly Market Commentary

The S&P 500 posted a gain for the fourth consecutive month as investors continued to embrace the prospects of a September rate cut, a robust economic outlook, and strong corporate earnings. The much-anticipated second-quarter results from NVidia were met with...

Weekly Market Commentary

US equity markets ended the week with a powerful move to the upside after Fed Chairman J. Powell indicated that the balance of risk had shifted to the labor market, leaving the door open for a September rate cut. The final day of trading wiped out losses incurred in...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Pacific Empire Financial) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Pacific Empire Financial.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Eligible Designated Beneficiaries and Roth IRA Contributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Hello! I have been a big fan for a long time. I have a question regarding a Roth IRA I inherited from my younger brother last year. I have heard that I must empty this account by the end of 2035. I...

Spousal IRA Contributions

By Sarah Brenner, JD Director of Retirement Education IRA and Roth IRA contributions are only permitted when you have taxable “compensation” or earned income. Typically, whether or not a person has compensation is a relatively straightforward determination. For...

Inherited Roth IRAs and Successor Beneficiaries

By Andy Ives, CFP®, AIF® IRA Analyst In our December 8, 2025 Slott Report entry (“Yes, RMDs Apply to Inherited Roth IRAs, But…”), we wrote about the application of required minimum distributions (RMDs) to inherited Roth IRAs. As expected, that article received...

SIMPLE Plan Contributions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Hello, I am searching for confirmation that Roth SIMPLE IRA contributions are not limited by modified adjusted gross income (MAGI) in the same way that Roth IRA contributions are. This is not addressed in any of the...

Making Sense of the Roth 401(k)-to-Roth IRA Rollover Rules

By Ian Berger, JD IRA Analyst One of the most common retirement account transactions – rolling over Roth 401(k) funds to Roth IRAs – is also one of the most complicated tax-wise. That’s because the rollover involves two five-year holding periods, one for...

How Your RMD Statement Can Help You

Sarah Brenner, JD Director of Retirement Education The rules for required minimum distributions (RMDs) can be complicated and, under the law, the responsibility to get it right rests with the IRA owner. If you are required to take an RMD from your IRA for 2026,...

Taxes on Required Minimum Distributions and Qualified Charitable Distributions from Trusts: Today’s Slott Report Mailbag

Ian Berger, JD IRA Analyst Question: Does a non-spouse eligible designated beneficiary (EDB) have to pay taxes on required minimum distributions (RMDs) either at the end of ten years or with annual RMDs? Answer: Any EDB (other than a minor child) can stretch...

2026: Here We Go Again!

By Andy Ives, CFP®, AIF® IRA Analyst It’s a new year, and the slate is wiped clean. Here we go again! While we are only one week into 2026, there are some important IRA and work plan transactions to be aware of: First RMDs. For anyone turning age 73 in 2026, this year...

Coming Soon: The Thrift Savings Plan Will Start Offering In-Plan Roth Conversions

By Ian Berger, JD IRA Analyst Since 2010, participants in certain private sector 401(k) plans have been able to boost their Roth retirement savings by doing an “in-plan Roth conversion” of non-Roth plan funds to a Roth account within the same plan. This plan feature...

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Pacific Empire Financial, deems reliable but in no way does Pacific Empire Financial guarantee its accuracy or completeness. Pacific Empire Financial had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Pacific Empire Financial. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Pacific Empire Financial, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

7 Costly Medicare Mistakes (and How to Avoid Them)

1) Waiting too long to enroll If you miss your Initial Enrollment Period (the 7-month window around your 65th birthday) and don’t have qualifying employer coverage, you may face lifelong Part B and Part D penalties.Fix: Mark your IEP dates, or talk with an advisor 2–3...

read more

“Snowbird Medicare: A Two-State Plan That Actually Works”

Snowbird Medicare: A Two-State Plan That Actually Works If you split the year between two homes, you already know about duplicate utility bills and the art of packing one jacket that somehow works in two climates. But there’s one thing snowbirds often overlook: how to...

read more

Turning 65? The No-Stress Medicare Timeline (What to Do & When)

Medicare doesn’t have to be confusing. Use this simple month-by-month checklist to enroll on time, avoid penalties, and choose coverage that fits your doctors, prescriptions, travel, and budget. 6–9 Months Before Your 65th Birthday: Get Your Bearings Learn the basics:...

read more

7 Smart Moves to Cut Health Costs and Get Better Coverage with Medicare (and the Right Insurance Pairings)

If you’re approaching 65, already on Medicare, or helping a parent navigate coverage, you’ve probably noticed two things: The rules change often, and 2) small choices can have big cost consequences. The good news? With a little structure—and the right partner—you can...

read more

What Is Medicare? A Friendly Guide to Parts A, B, C & D

Meta: A simple walkthrough of Medicare Parts A, B, C & D—what each covers, who’s eligible, and how they work together.Takeaways: Four parts, different roles Enrollment timing matters Coverage & costs vary by plan and area Post:Medicare is the federal health...

read more

Medicare in 2025: What You Need to Know About Your Coverage

As we step into 2025, understanding your Medicare needs is more important than ever. With healthcare costs rising and plan options evolving, staying informed ensures you have the right coverage to protect both your health and your financial well-being. Whether you’re...

read more

How are Medicare costs and benefits changing for 2026?

Learn how premiums, out-of-pocket costs and income-related surcharges are changing for 2026 Medicare coverage What are the changes to Medicare benefits for 2026? Medicare changes for 2026 include increases for Medicare Part B and Part A premiums and cost-sharing,...

read more

Six Changes Coming to Social Security in 2026

Big changes are coming to Social Security in the year ahead, impacting everything from the size of your benefit check to your full retirement age. Here's what you need to know. In January 2026, several changes to Social Security will take effect, impacting everything...

read more

Vaccines Medicare Covers for Free in 2025

The U.S. is experiencing an outbreak of measles and is on track to have the most whooping cough cases since 1948. These vaccines Medicare covers for free can keep you safe. Did you know that Medicare fully covers many vaccines for its beneficiaries? Well, they do....

read more

7 Costly Medicare Mistakes (and How to Avoid Them)

1) Waiting too long to enroll If you miss your Initial Enrollment Period (the 7-month window around your 65th birthday) and don’t have qualifying employer coverage, you may face lifelong Part B and Part D penalties.Fix: Mark your IEP dates, or talk with an advisor 2–3...

“Snowbird Medicare: A Two-State Plan That Actually Works”

Snowbird Medicare: A Two-State Plan That Actually Works If you split the year between two homes, you already know about duplicate utility bills and the art of packing one jacket that somehow works in two climates. But there’s one thing snowbirds often overlook: how to...

Turning 65? The No-Stress Medicare Timeline (What to Do & When)

Medicare doesn’t have to be confusing. Use this simple month-by-month checklist to enroll on time, avoid penalties, and choose coverage that fits your doctors, prescriptions, travel, and budget. 6–9 Months Before Your 65th Birthday: Get Your Bearings Learn the basics:...

7 Smart Moves to Cut Health Costs and Get Better Coverage with Medicare (and the Right Insurance Pairings)

If you’re approaching 65, already on Medicare, or helping a parent navigate coverage, you’ve probably noticed two things: The rules change often, and 2) small choices can have big cost consequences. The good news? With a little structure—and the right partner—you can...

What Is Medicare? A Friendly Guide to Parts A, B, C & D

Meta: A simple walkthrough of Medicare Parts A, B, C & D—what each covers, who’s eligible, and how they work together.Takeaways: Four parts, different roles Enrollment timing matters Coverage & costs vary by plan and area Post:Medicare is the federal health...

Medicare in 2025: What You Need to Know About Your Coverage

As we step into 2025, understanding your Medicare needs is more important than ever. With healthcare costs rising and plan options evolving, staying informed ensures you have the right coverage to protect both your health and your financial well-being. Whether you’re...

How are Medicare costs and benefits changing for 2026?

Learn how premiums, out-of-pocket costs and income-related surcharges are changing for 2026 Medicare coverage What are the changes to Medicare benefits for 2026? Medicare changes for 2026 include increases for Medicare Part B and Part A premiums and cost-sharing,...

Six Changes Coming to Social Security in 2026

Big changes are coming to Social Security in the year ahead, impacting everything from the size of your benefit check to your full retirement age. Here's what you need to know. In January 2026, several changes to Social Security will take effect, impacting everything...

Vaccines Medicare Covers for Free in 2025

The U.S. is experiencing an outbreak of measles and is on track to have the most whooping cough cases since 1948. These vaccines Medicare covers for free can keep you safe. Did you know that Medicare fully covers many vaccines for its beneficiaries? Well, they do....